Some Known Details About Simply Solar Illinois

Some Known Details About Simply Solar Illinois

Blog Article

What Does Simply Solar Illinois Mean?

Table of ContentsSimply Solar Illinois Can Be Fun For EveryoneThe Buzz on Simply Solar IllinoisSimply Solar Illinois Can Be Fun For EveryoneThe Main Principles Of Simply Solar Illinois Things about Simply Solar Illinois

Our group partners with neighborhood areas across the Northeast and past to supply tidy, budget-friendly and reputable power to promote healthy and balanced neighborhoods and keep the lights on. A solar or storage project supplies a number of advantages to the community it offers. As technology advancements and the price of solar and storage decline, the economic benefits of going solar remain to climb.Support for pollinator-friendly environment Environment repair on polluted websites like brownfields and landfills Much required color for animals like sheep and chicken "Land banking" for future farming use and soil quality renovations Because of environment modification, severe climate is coming to be more constant and turbulent. Consequently, house owners, organizations, communities, and utilities are all ending up being an increasing number of interested in protecting energy supply options that supply resiliency and energy safety and security.

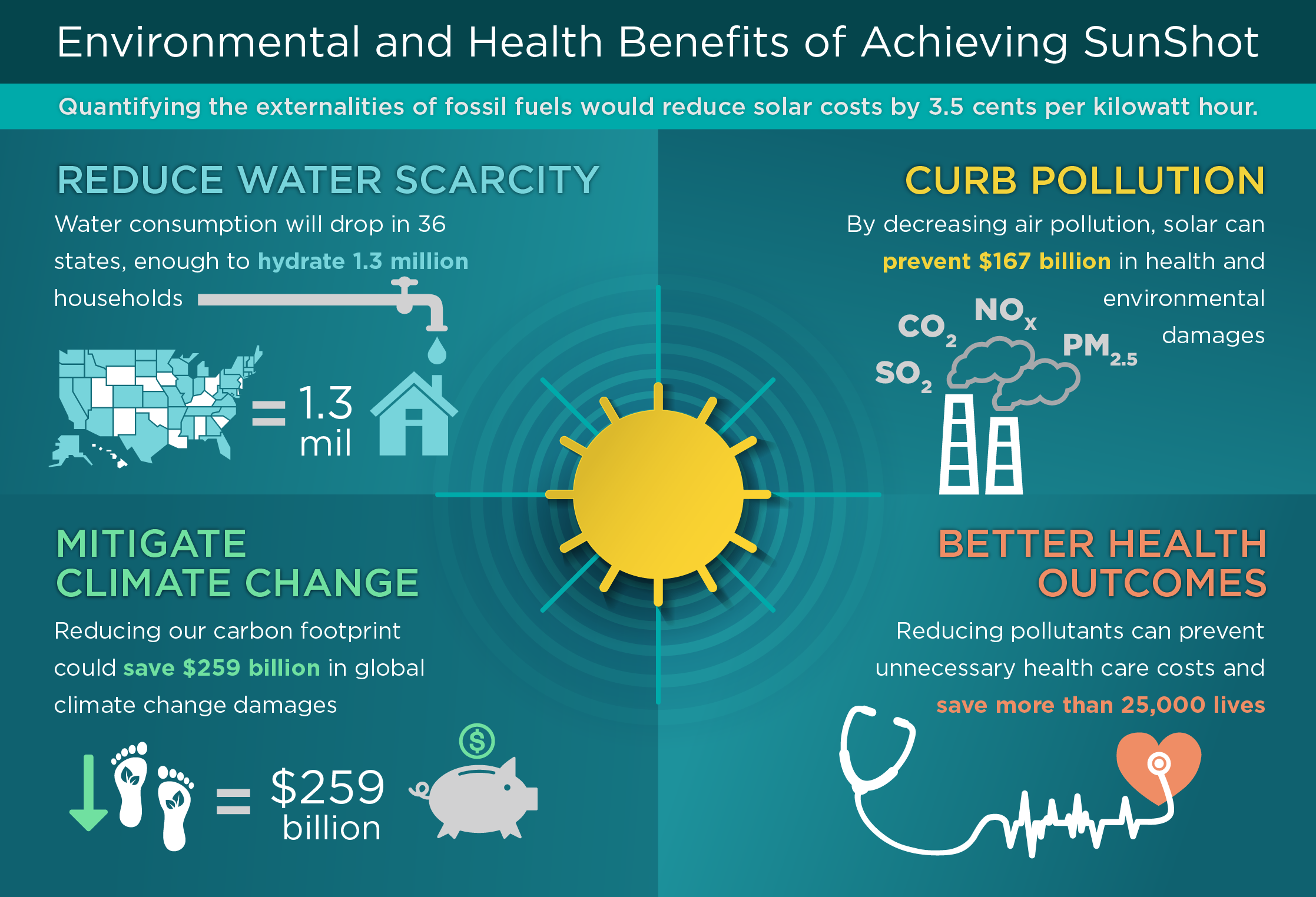

Environmental sustainability is another key driver for businesses buying solar power. Lots of companies have robust sustainability objectives that include decreasing greenhouse gas exhausts and making use of less resources to help minimize their effect on the native environment. There is a growing seriousness to resolve environment change and the stress from consumers, is getting to the leading levels of organizations.

Rumored Buzz on Simply Solar Illinois

As we approach 2025, the combination of photovoltaic panels in commercial tasks is no more just an option however a calculated need. This blogpost delves right into just how solar power works and the multifaceted benefits it brings to commercial buildings. Solar panels have actually been used on domestic structures for numerous years, however it's only just recently that they're becoming a lot more common in commercial building and construction.

It can power illumination, home heating, a/c and water home heating in business structures. The panels can be set up on rooftops, car park and side backyards. In this write-up we review how photovoltaic panels work and the advantages of utilizing solar energy in business structures. Electrical energy expenses in the united state are raising, making it extra costly for companies to operate and much more difficult to intend in advance.

The U - Simply Solar Illinois.S. Power Information Management expects electric generation from solar to be the leading source of development in the united state power field through completion of 2025, with 79 GW of new solar ability predicted to find online over the next two years. In the EIA's Short-Term Energy Outlook, the firm stated it expects renewable resource's total share of electrical power generation to rise to 26% by the end of 2025

See This Report about Simply Solar Illinois

The photovoltaic solar cell takes in solar radiation. The cords feed this DC electricity right into the solar inverter and convert it like this to rotating power (AIR CONDITIONING).

There are a number of ways to save solar power: When solar energy is fed read more into an electrochemical battery, the chemical reaction on the battery components keeps the solar energy. In a reverse reaction, the existing leaves from the battery storage space for usage. Thermal storage space uses mediums such as liquified salt or water to retain and soak up the heat from the sun.

Solar panels considerably lower energy costs. While the initial financial investment can be high, overtime the expense of mounting solar panels is recovered by the cash saved on power expenses.

What Does Simply Solar Illinois Do?

By setting up photovoltaic panels, a brand reveals that it cares concerning the atmosphere and is making an effort to lower its carbon impact. Structures that rely entirely on electrical grids are at risk to power blackouts that occur throughout bad weather condition or electrical system breakdowns. Solar panels mounted with battery systems enable commercial structures to proceed to function throughout power interruptions.

The Of Simply Solar Illinois

Solar energy is among the cleanest types of energy. With resilient guarantees and a production life of as much as 40-50 years, solar investments contribute considerably to environmental sustainability. This change towards cleaner power resources can bring about more comprehensive economic benefits, including reduced environment change and environmental degradation costs. In 2024, home owners can profit from government solar tax motivations, enabling them to offset virtually one-third of the acquisition rate of a planetary system through a 30% tax obligation credit history.

Report this page